contra costa county sales tax increase 2020

Please contact the local office nearest you. Online videos and Live Webinars are available in lieu of in-person classes.

The minimum combined 2022 sales tax rate for Contra Costa County California is.

. Posted by angela angie a resident of San Ramon on Oct 30 2020 at 255 am angela angie is a registered user. The Contra Costa County sales tax rate is. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc.

Contra Costa County was not alone tax proposals in Alameda Santa Clara San Mateo Marin and Solano counties also approved various tax hikes. What is the sales tax rate in Contra Costa County. The Contra Costa County supervisors last month approved spending 10000 for a poll by the firm FM3 Research to help determine voter support for the sales tax measure.

A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency. The bill also grants Contra Costa County an additional authorization for another 12 sales tax increase such as for the Contra Costa Transportation Authority thereby boosting the maximum countywide rate to 925 plus any current city rates. 2020 rates included for use while preparing your income tax deduction.

2020 Contra Costa County The unincorporated areas receipts from January through March were 181 below the first sales period in 2019. This rate includes any state county city and local sales taxes. California City County Sales Use Tax Rates.

The 2018 United States Supreme Court decision in South Dakota v. City of Concord located in Contra Costa County 8750. That would bring Contra Costas sales-tax rate up to around 10 percent.

Djn0e3qka T0wm Director Of Human Resources Src Hingemarketing Com Customer Persona Persona Human Resources. And another round of sales-tax leapfrog is not a game which County residents likely hope to win. Election results Nov 4 2020 November 2020 Election.

Uninc This Quarter 27 Pools 7 Restaurants 7 AutosTrans. 1788 rows CDTFA public counters are now open for scheduling of in-person video or phone appointments. It was approved.

The California state sales tax rate is currently. The state and federal government would. 11 Building 17 BusInd.

Webpage and select. Glazers bill would allow Contra Costa County to put forward the tax measure with revenues going to its general fund and do so by only a simple majority vote. Concord voters will consider Measure V which also would continue and increase an existing.

Contra costa county sales tax increase 2020 Monday April 4 2022 Edit. Find a Sales and Use Tax Rate by Address. CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table.

15 hours agoThough completed in 2020 Station 95 could not open because East Contra Costa Fire Protection District lacked money to staff it that is until county Measure X sales tax monies provided funds. Cash allocations were pulled down by year ago adjustments and by eligible companies taking advan-tage of the extra 90-days to file tax returns under the Governors recent Executive Order. Measure X is a sales tax measure thats expected to generate 81 million dollars a year for the next 20 years.

This is the total of state and county sales tax rates. Located in Contra Costa County 1. Thereby increasing the total sales tax rate in Contra Costa County from 825 to 875.

Contra Costa sales-tax rates already range from 825 to 975 tied for 7th highest among Californias 58 counties. The Contra Costa sales tax measure will depend on passage of state Senate Bill 1349 drafted by Sen. 7 ConsGoods 7 FoodDrug 16 Fuel ADJUSTED FOR ECONOMIC DATA 4Q 2020 CONTRA COSTA COUNTY SALES TAX UPDATE STATEWIDE RESULTS The local one cent sales and use tax from sales occurring October through December the holiday shopping.

City of San Rafael located in Marin County 9000. A county-commissioned poll showed at least 59 percent support for the tax depending on various specific inclusions. City of Crescent City located in Del Norte County.

The December 2020 total local sales tax rate was 8250. Heres how Contra Costa Countys maximum. The Contra Costa County Sales Tax is collected by the merchant on all.

If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine. Some cities and local governments in Contra Costa County collect additional local sales taxes which can be as high as 45. A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax.

The latest sales tax rate for Contra Costa County CA. However 2020 was not a normal year for processing returns. For questions about filing extensions tax relief and more call.

The Contra Costa County Sales Tax is 025. A yes vote supported authorizing an extension and increase to the current sales tax from 05 to 1 generating an estimated 27 million per year for city services including emergency response. Just as Contra Costa Countys top public health official Anna Roth informed the Contra Costa County Board of Supervisors on Tuesday the number of COVID-19 positive cases has risen to 2586 cases an increase from 92 cases three weeks earlier and with 79 COVID -19 stricken patients in county hospitals up from 35 patients in county hospital.

Businesses impacted by the pandemic please visit our. Contra Costa County Measure X was on the ballot as a referral in Contra Costa County on November 3 2020. Sales Tax November 2020.

You can see a list of all cities with tax increases in effect. Each of the Contra Costa Transportation Authoritys two recent sales-tax-increase campaigns Measure X 2016 and Measure J March 2020 was bankrolled by about 13 Million in contributions made primarily by existing and prospective vendors and contractors to the County with an odor thereby of shakedowns and anticipated kickbacks. Steve Glazer D-Orinda that would authorize the county to impose a transactions and use tax of.

1 hour agoThough completed in 2020 Station 95 could not open because East Contra Costa Fire Protection District lacked money to staff it that is until county Measure X sales tax monies provided funds. The current sales tax in San Pablo is 875.

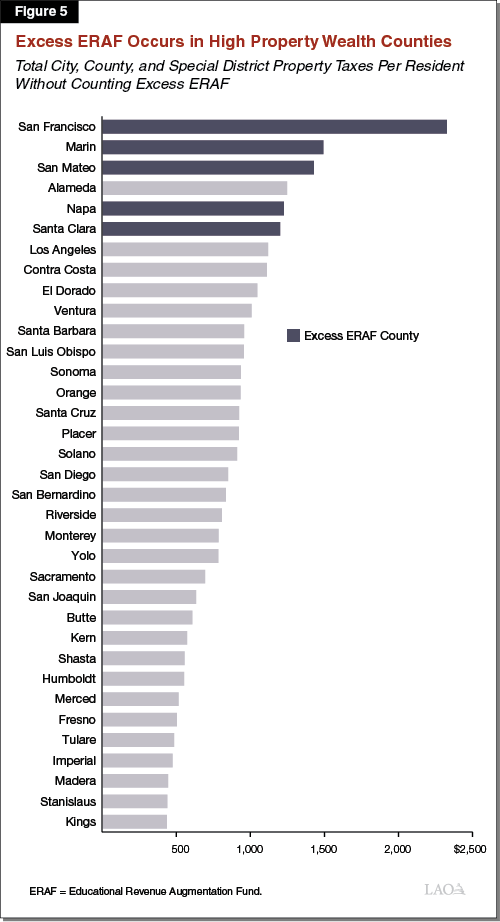

Excess Eraf A Review Of The Calculations Affecting School Funding

Contra Costa County California Ballot Measures Ballotpedia

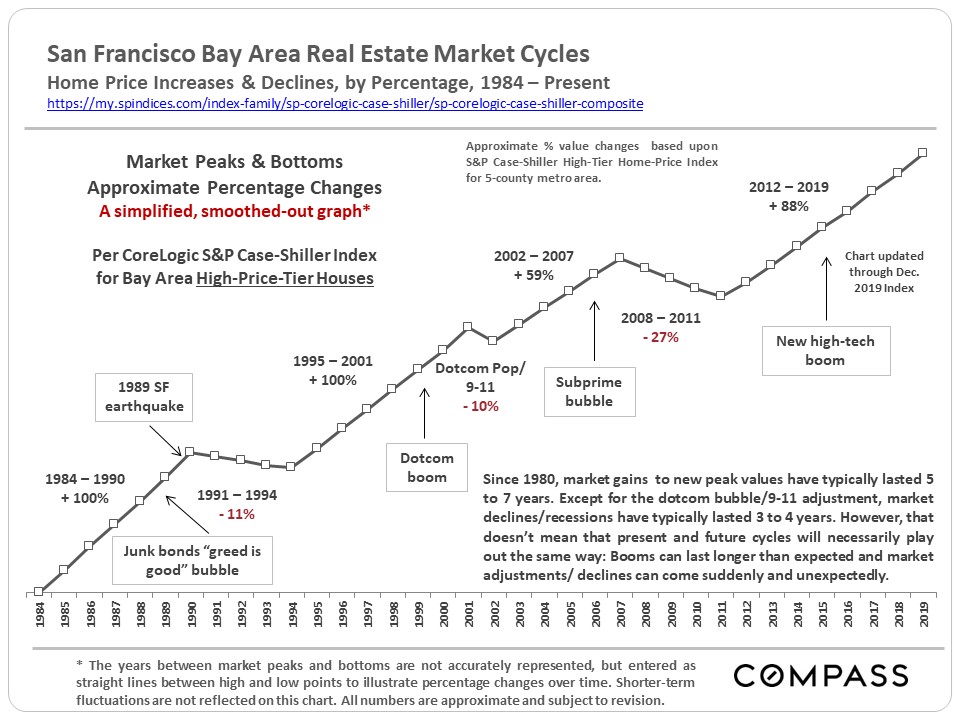

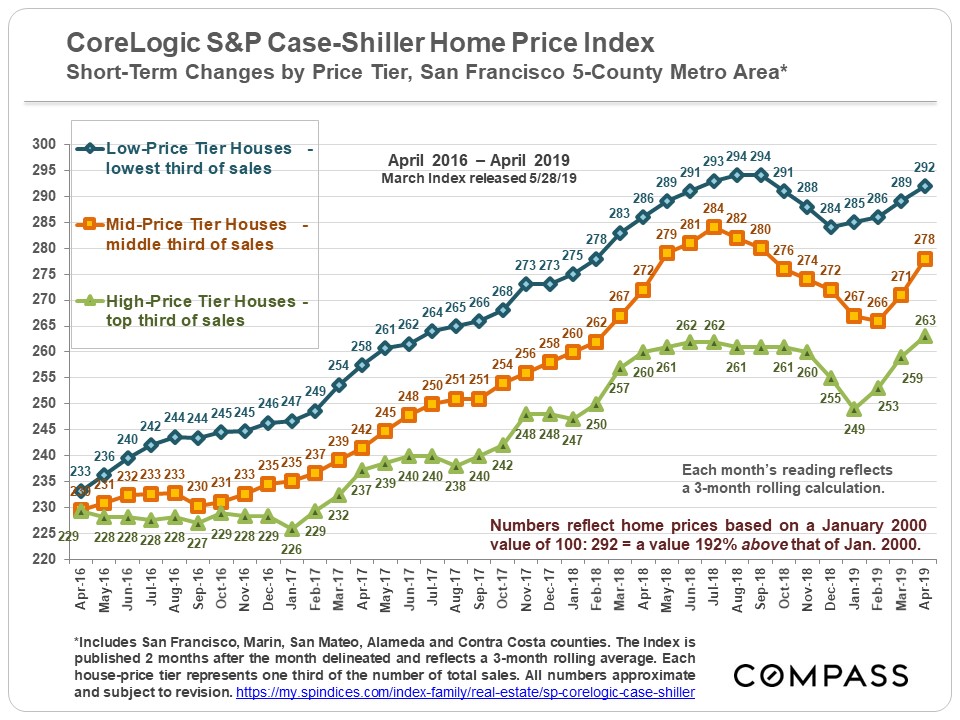

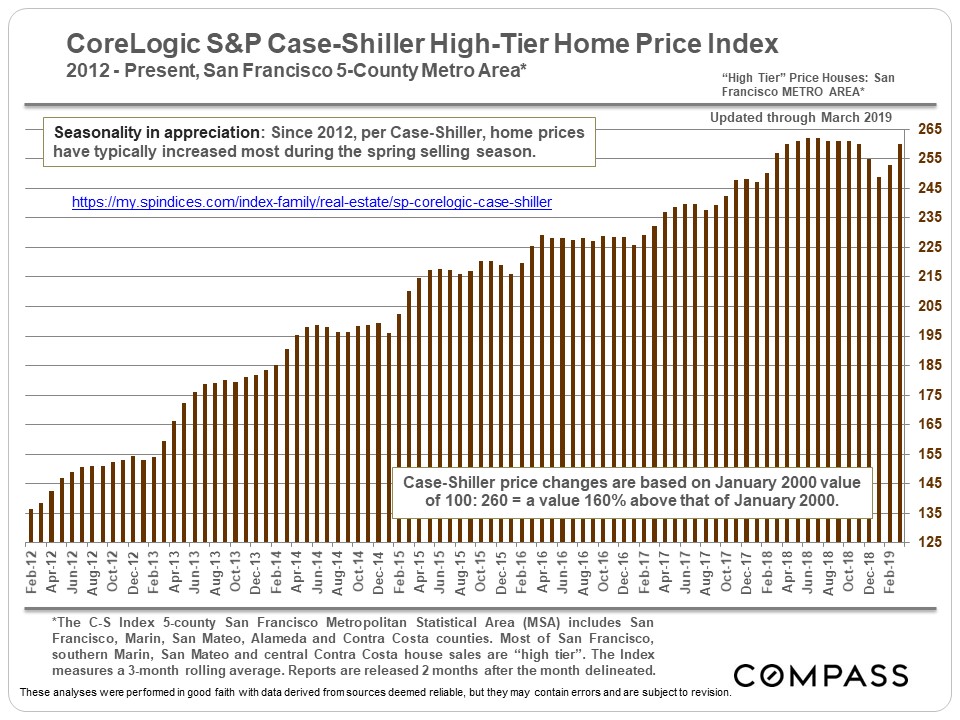

30 Years Of Bay Area Real Estate Cycles Compass Compass

30 Years Of Bay Area Real Estate Cycles Compass Compass